The famous quote by Warren Buffett goes: “If you don’t find a way to make money while you sleep, you will work until you die.” Keeping your money in the bank with little or no return is a good way to go broke quickly and pretty much work till you die.

That’s because the interest rate is very little or non-existent. In fact, you are constantly being debited for basic transactions, card maintenance fees and other numerous bank charges that never came with the terms and conditions.

If you put 100 thousand Naira in the bank, the chances that the money will depreciate within a month is very high. This is because the money is just sitting pretty, with no visible returns.

The best way to start the process of being truly financially free is to get returns or profit on your savings. Yes, it’s time to fire your bank and find someplace else to put your money. These six (6) options will help you earn a lot more.

This article is a compilation of how you can invest your savings without many risks. You can create a strategy for short and long-term savings goals with this list.

1. Saving or Earning in Dollars, Pounds or Euros

The exchange rate keeps soaring higher and higher. Anyone earning and saving in Naira without a significant salary increase may be living from hand to mouth. This is due to the devaluation of our currency and inflation.

The smart way to combat this is to save and possibly earn one of those hard currencies.

Take the dollar-naira rate between December 2020 and 2021 as an example; the exchange rate rose from 380 to 411 – meaning whatever Naira was in the bank lost a great deal of value.

For saving in a foreign currency, you need to study the market. Know when to buy and sell.

You can also save your money in dollars with online crypto trading platforms – decentralized systems where you keep your money intact without unnecessary charges on your savings.

2. Lending it to Crypto traders

Yes, I know we mentioned that it would be risk-free, but is there anything done in this life without taking a little risk?

For crypto markets, you can put a small portion of your savings for returns. This kind of trading is the future, so if you are shying away, don’t bother because the time will come when crypto will be all there is.

Crypto traders help you trade with their professional skills, and all you have to do is share the profit. If you are someone who takes risks, this might be up your alley.

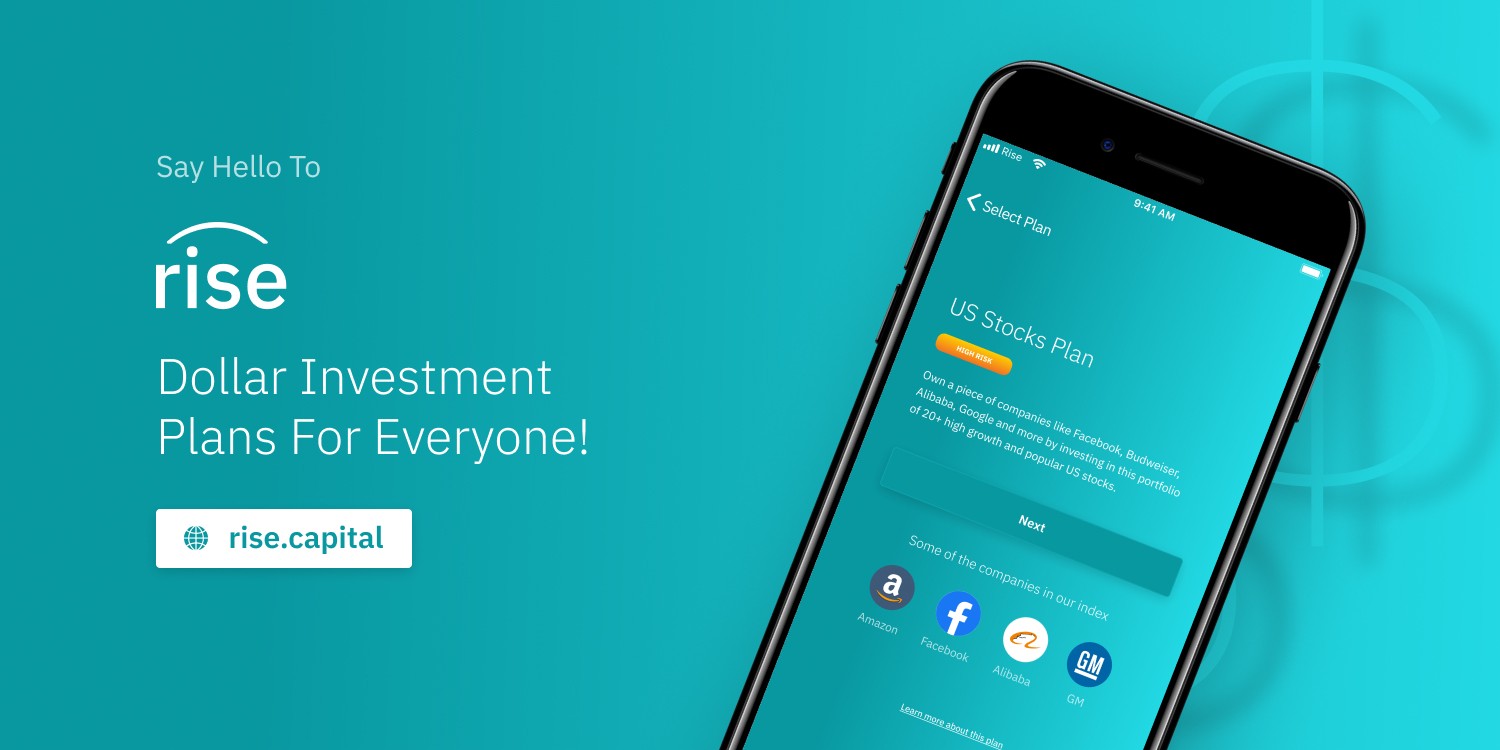

3. Saving and Investing with Risevest

Risevest is a fin-tech application that allows Africans to benefit from the best wealth-creating opportunities across the world.

What Risevest does, in simple terms, is allow people to make dollar-denominated investments in more productive markets. As a store of value, the dollar performs better than the Naira.

Risevest offers three asset classes for now – stocks, real estate, and fixed income. All three asset classes are rated on the application according to their risk factors. Stocks are rated high-risk, real estate are classed as medium risk, while fixed-income investments are designated as low-risk.

You earn per annum on your fixed capital. Its interest rates are far better than the banks.

4. Saving with Piggyvest

Piggyvest enables Nigerian debit cardholders to save little money for either long or short term plans.

They automate the process of saving tiny amounts daily, weekly, or monthly; and then allow you to withdraw for free on only set withdrawal dates, thereby practically making saving more possible for you by eliminating the temptation to withdraw the money.

Piggyvest is the platform that helps individuals and businesses manage their finances effectively – save and invest with ease. Its system is similar to that of a bank. It lets you save with higher interest rates and return on your savings.

5. Trove

Trove is an investment app that aims to make the process of finding and selecting investments like cryptocurrencies, Stocks & Bonds easy and approachable for beginners.

With Trove, you can find and buy US stocks from Nigeria. It’s a wealth-tech that grows your financial assets, down to payment and buying and selling stocks and investments.

The Trove platform makes the whole process around micro-investing interesting, from keeping you updated on your trading to providing a personalized news feed of finance headlines.

6. OWealth by Opay

OWealth is a Savings and investment platform built into the OPay application that enables you to save your funds for an annual interest. The rate per annum is fixed at 10%, which is a better offer compared to the 6% Nigerian bank rate.

OWealth investment allows investors to save any amount of money in both the short and long term. And no, it’s not a ponzi scam; it’s a licensed investment scheme.

The platform is designed in a way that all interests on your fixed funds will be calculated annually and credited daily. Any interest on your investment is payable on the capital you invested once it has completed a period of one day (24 hours).

You can withdraw your funds without losing the interest you have earned at any time.

Most of these investment schemes are better than conventional banks’ savings and investment deals. It is wise to take advantage of these investment platforms early enough to increase returns and lifetime earning streaks.

Add a comment